Office Hours

Mon-Fri 8:30am to 5:00pm

After Hours by Appointment

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health

Other Products

Banking

Would you like to create a personalized quote?

Michael Fancher

Office Hours

Mon-Fri 8:30am to 5:00pm

After Hours by Appointment

Address

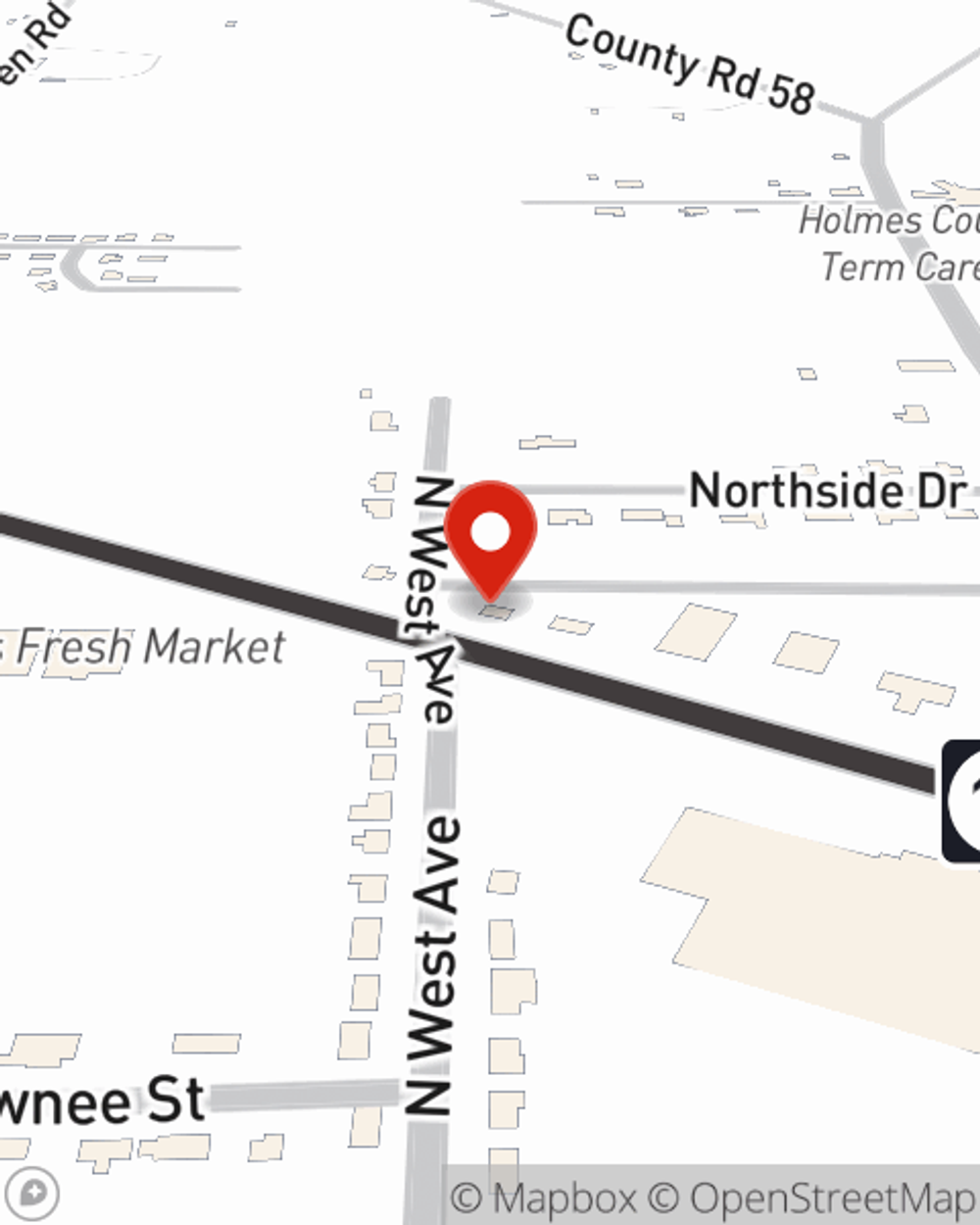

Durant, MS 39063

Office Hours

Mon-Fri 8:30am to 5:00pm

After Hours by Appointment

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health

Other Products

Banking

Would you like to create a personalized quote?

Office Info

Office Info

Office Hours

Mon-Fri 8:30am to 5:00pm

After Hours by Appointment

-

Phone

(662) 653-6439 -

Fax

(662) 580-1136

Languages

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health

Other Products

Banking

Office Info

Office Info

Office Hours

Mon-Fri 8:30am to 5:00pm

After Hours by Appointment

-

Phone

(662) 653-6439 -

Fax

(662) 580-1136

Languages

Simple Insights®

Tire maintenance, safety and care

Tire maintenance, safety and care

Yes, you do need to learn how to take care of your tires. These seven simple to-dos can take just minutes.

Car maintenance tasks you can do yourself

Car maintenance tasks you can do yourself

To combat auto repair costs that keep climbing, some auto maintenance can be done at home. Here are ones that are usually do-it-yourself.

How to help prevent drinking and driving

How to help prevent drinking and driving

Drinking and driving may result in serious injury, fatality, damage and legal ramifications. Help protect yourself from the dangers of drunk driving.

Social Media

Viewing team member 1 of 2

Lee McCullouch

License #10589527

Viewing team member 2 of 2

Teresa McDaniel

License #8004454